On May 12, the governor released the May Revision, an update to his January budget proposal for the fiscal year (FY) extending from July 2023 through June 2024. The Legislature has until June 15 to pass the budget.

Highlights include:

The Budget Deficit Is Larger Than Previously Estimated. Under the updated revenue and expenditure estimates, the state’s budget shortfall is now estimated to be $31.5 billion, a $9.3 billion increase compared to the prior budget estimates. This increase in the budget problem is due to the flagging performance of financial markets and the state economy amid inflationary pressures and federal regulators’ efforts to bring inflation under control. The estimates do not assume an economic recession, which would swell the budget problem by tens of billions of dollars in FY 2023-24 and beyond.

New Proposed Solutions Do Not Include Additional Cuts or Spending Delays in Core Health Care Programs. To ensure a balanced budget in accordance with constitutional requirements, the governor proposes various budget solutions such as spending reductions and delays, new revenues, borrowing from state funds, and a withdrawal from a special reserve fund. These do not include new cuts or delays in health care. As such, the expansion of comprehensive Medi-Cal coverage to undocumented adults ages 26 through 49 is still scheduled to take effect in January 2024. There are also no proposed delays in funding for the health care workforce beyond what was previously proposed. Rather, the governor proposes to solve the budget problem by accelerating and increasing revenues from the managed care organization (MCO) tax and various other solutions outside of the health care arena.

More Work Must be Done to Secure Broad Financial Relief for Hospitals. The revised budget proposal includes $150 million in funding for the Distressed Hospital Loan Program, which the governor is expected to sign into law this week. This program would provide potentially forgivable loans to certain nonprofit and public hospitals on the financial brink. The governor does not propose additional financial relief or statutory changes authorizing Medi-Cal reimbursement increases for hospitals. This stands in contrast to the Senate’s budget plan, released in April, which would provide $400 million annually for four years to support struggling hospitals.

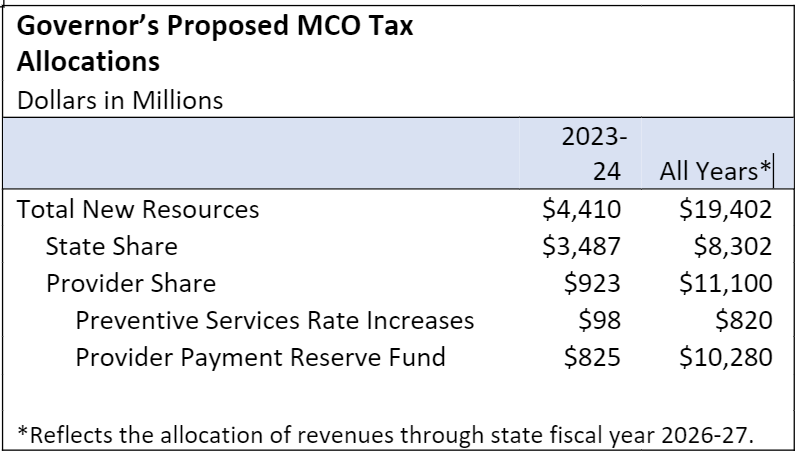

Higher MCO Tax Would be Mostly Dedicated to Solving the State’s Budget Problem. For years, the state has imposed a tax on MCOs that leverages significant federal funding. This tax lapsed in January 2023. Earlier this year, the governor proposed a three-year renewal of the MCO tax beginning in January 2024, which would bring in $6.5 billion in new state resources over its lifespan. Now, the governor is proposing to accelerate implementation of the tax to April 2023 and generate $19.4 billion in new state resources over its lifespan by imposing higher tax rates.

The governor is proposing to use nearly $3.5 billion of these revenues in 2023-24 to solve the state budget problem, and to dedicate the remaining $923 million to provider payment increases in Medi-Cal. With the exception of the $98 million for Medi-Cal rate increases for certain preventive services that would start in January 2024, the governor proposes to put the remaining funding for provider payment increases into a reserve fund to support yet unspecified payment increases beginning in 2025. Over the life of the tax, this would result in nearly $10.3 billion in MCO tax money being dedicated to unspecified provider payment increases, a portion of which could go to hospitals. However, the governor proposes to spend this money over eight to 10 years, meaning somewhat more than $1 billion annually would be available to fund unspecified provider payment increases in Medi-Cal.

Other Notable Changes

- Whole Child Model (WCM) Expansion. Under WCM, California Children’s Services are delivered through Medi-Cal managed care plans rather than fee for service. Earlier this year, the governor proposed to expand WCM to 13 new counties. In the May Revision, the governor proposes to remove three counties from the proposed expansion — Alameda, Contra Costa, and Imperial. With this change, the expansion counties would include Colusa, Glenn, Nevada, Plumas, Sierra, Sutter, Tehama, Yuba, Mariposa, and San Benito.

- Long-Term Care Facilities Rate Year Shift. The governor proposes to convert the reimbursement rate year for specified long-term care facilities from August-through-July to a calendar-year basis, effective Jan. 1, 2024. This would impact distinct part-nursing facilities and could affect reimbursement levels for our affected nursing facilities.

- Updates Funding Schedule for Major Behavioral Health Initiatives. Over the last several years, billions of dollars have been devoted to various behavioral health initiatives, including developing provider capacity and supportive housing. The May Revision assumes a new spending schedule for these initiatives, which shifts nearly $1.3 billion previously planned for expenditure in 2023-24 to a subsequent fiscal year.

- Continues to Build on Plan to Pursue Institute for Mental Disease (IMD Waiver). Over the last several years, the state has been preparing to apply for a federal IMD waiver, which would unlock federal Medicaid funding for IMDs (including psychiatric hospitals that are designated as IMDs). This effort has been known as the California Behavioral Health Community-Based Continuum Demonstration. The May Revision renames this effort the Behavioral Health Community-Based Organized Networks of Equitable Care and Treatment (BH-CONNECT). The state plans to apply for the waiver this summer, with implementation occurring no sooner than January 2024. The May Revision includes a new $480 million workforce initiative funded through non-General Fund sources.

- CalRx. This is the governor’s existing initiative to manufacture lower cost insulin. The May Revision proposes an additional $30 million in one-time funding from the Opioid Settlement Fund to develop, manufacture, or procure naloxone.