Background

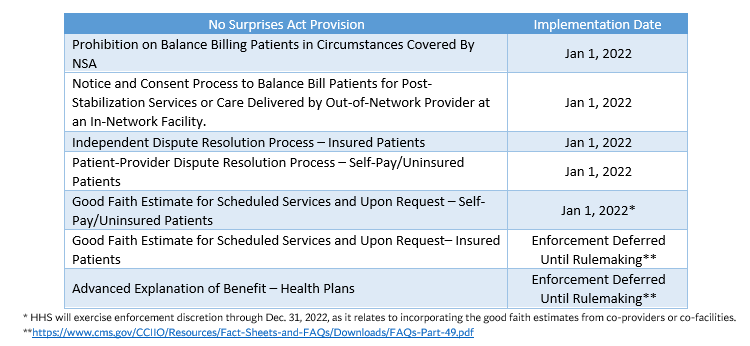

On December 27, 2020, the No Surprises Act was signed into law as part of the Consolidated Appropriations Act of 2021. The No Surprises Act addresses surprise medical billing at the federal level, with most sections of the legislation effective Jan. 1, 2022. The Departments of Health and Human Services, Treasury, and Labor will issue regulations and guidance to implement numerous provisions.

The No Surprises Act prohibits balance billing for emergency services and in instances where health care services are received from an out-of-network provider at an in-network facility for federally regulated health insurance products. In instances covered by the Act, patient cost sharing is limited to the in-network amount. If a provider or facility is not satisfied with the initial payment from a health plan for out-of-network services covered by the Act, the provider or facility may attempt to negotiate a satisfactory payment with the plan. In instances where an appropriate amount cannot be negotiated, the provider or facility may submit the claim to an independent dispute resolution process to determine the appropriate payment amount. The law also requires providers and facilities to give patients a good faith estimate of expected charges for scheduled services or upon request.

CHA is providing resources to help members navigate the implementation of the No Surprises Act requirements.

Important dates:

- Jan. 1, 2022: Most provisions of the No Surprises Act go into effect for all hospitals, health systems, and health plans.

This contact information is restricted to members.

Resources

- Comparison Grid: Federal and CA State Out-of-Network Service Billing Laws

- CHA State-Specific Language for Model No Surprises Act Forms

- CMS Model Language for No Surprises Act Forms

- Part II No Surprises Act Interim Final Rule Summary

- No Surprises Act Enforcement Provisions Proposed Rule Summary

- Part I No Surprises Act Interim Final Rule Summary

- No Surprises Act Legislation Summary

- Alert: Urge Representatives to Ensure Congressional Intent in Implementation of No Surprises Act

- CHA Comment Letter on Department of Managed Health Care No Surprises Act Draft All Plan Letter

- CHA Comment Letter on Part II No Surprises Act Interim Final Rule

- CHA Comment Letter on No Surprises Act Enforcement Provisions Proposed Rule

- CHA Comment Letter on Part I No Surprises Act Interim Final Rule

- CHA Technical Recommendations on Implementation of the No Surprises Act

- FAQs about the No Surprises Act: Provides answers to general questions about the requirements across the range of No Surprises Act Provisions.

- FAQs for providers and facilities about the No Surprises Act rules, independent dispute resolution, and exceptions to the new rules and requirements.

- FAQs about the Federal IDR process, IDR entity qualifications and the application process, and fees.

- FAQS about IDR process administrative fee in response to Texas Medical Association v. United States Department of Health and Human Services opinion and order

- Federal Independent Dispute Resolution Process Checklist: The Departments of Treasury, Labor, and Health and Human Services have issued a checklist of independent dispute resolution (IDR) process requirements for group health plans and group and individual health insurance issuers.

- Chart for Determining the Applicability for the Federal Independent Dispute Resolution (IDR) Process: https://www.cms.gov/sites/default/files/2022-04/Federal-IDR-State-Territory-Applicable-Chart.pdf

- Chart Regarding Applicability of the Federal Independent Dispute Resolution Process in Bifurcated States – assists in determining whether the Federal IDR process or a specified state law or All-Payer Model Agreement applies for determining out-of-network claims covered under the No Surprises Act

- Federal Independent Dispute Resolution Process Guidance for Certified IDR Entities: CMS has released additional guidance on the IDR process. While the guidance is intended for the IDR entities, it offers providers a useful overview of the steps and timelines necessary to complete the federal IDR process. It clarifies that providers must use the Department of Labor’s model “open negotiation notice” to satisfy the open negotiation requirement necessary to access the IDR process. The guidance also describes the data elements required to complete the “notice of IDR initiation” if the open negotiation does not result in an adequate payment offer from the health plan for services covered under the No Surprises Act. The document includes a timeline for the IDR process beginning on page 6 and lists the documents providers are required to use during each step of the process on page 36.

- Revised Certified IDR Entities Guidance and Revised IDR Disputing Parties Guidance: Provides updates to conform with the recent Texas Medical Ass’n, et al. v United States Department of Health and Human Services, et al. decision and provide further direction to certified IDR entities and disputing parties about the Federal IDR process.

- IDR Guidance for Disputing Parties (March 2023): This guidance document is effective for payment determinations made on or after February 6, 2023 for items and services furnished on or after October 25, 2022 for plan years (in the individual market, policy years) beginning on or after January 1, 2022 by an out-of-network provider.

- FAQs Related to IDR and Notice and Consent: CMS has provided FAQs which will be updated covering the IDR and Notice and Consent Process.

- List of Independent Dispute Resolution Entities: This list includes the organizations certified to serve as IDR entities in the federal dispute resolution process between health plans and providers. The application process for IDR entities remains open and the list will be updated on a rolling basis.

- Guidance on Uninsured/Self-Pay Good Faith Estimates and the Patient Provider Dispute Resolution Process: The document summarizes the key requirements from the interim final rules related to the provision of good faith estimates (GFE) to uninsured/self-pay individuals and patient provider dispute resolution process (PPDR). The document includes several examples of both the GFE and PPDR process starting on pages 10 and 13. A timeline of steps included in the PPDR process is included on page 21.

- Good Faith Estimate FAQs (Part I): CMS has provided FAQs for the Self-Pay/Uninsured Good Faith Estimate requirement. These FAQs will be updated by the agency periodically.

- Good Faith Estimate (GFE) for Uninsured/Self-Pay Individuals FAQs (Part II): Among other things, this document confirms that if a patient schedules a service less than three days in advance, the provider does not need to provide a GFE. This FAQ also addresses the scenario where the patient has insurance coverage and seeks to use it when the service is scheduled, but then is uninsured on the date of service.

- Good Faith Estimate FAQs (Part III): CMS has provided FAQs about the extension of enforcement discretion of certain GFE requirements for uninsured or self-pay individuals.

- Good Faith Estimate FAQs (Part IV): CMS has provided additional FAQs certain GFE requirements for uninsured or self-pay individuals.

- No Surprises Act: Final Rule Overview and Implementation Update (Sept. 30, 2022)

- No Surprises Act: Implementation Update and Lessons Learned (July 11, 2022)

- No Surprises Act: Dispute Resolution Process and Self-Pay Estimates (Nov. 4, 2021)

- No Surprises Act: Implementation for California Hospitals (Aug. 6, 2021)

- No Surprises Act: Hospital Contracting and Compliance Implications (March 24, 2021)

- American Hospital Association (AHA)/American Medical Association Challenge (AMA)

- Federation of American Hospitals/Association of Academic Medical Centers/America’s Essential Hospitals/Catholic Health Association/Children’s Hospitals Association Amicus Brief in Support of AHA/AMA Legal Challenge