Earlier this week, the governor released his January budget proposal for 2023-24, marking the opening of this year’s state budget process. The budget proposes revised spending of $240 billion in 2022-23 and $224 billion in spending for 2023-24 (the fiscal year beginning in July 2023).

As anticipated, and in sharp contrast to the strong state fiscal conditions of recent years, the budget projects a significant drop in revenue — of $29.5 billion compared to previous estimates — due to current economic and financial conditions. This projected drop in revenue creates a $23 billion gap between available revenues and anticipated expenditures before proposed budget solutions are taken into account.

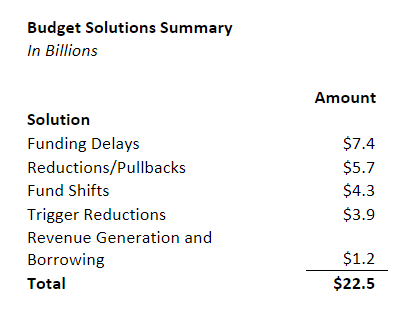

The projected deficit is addressed in the proposed budget through a variety of budget solutions, which do not include drawing down the state’s reserves. As the table below shows, these primarily include delaying funding for various augmentations that have been approved in recent years to beyond 2023-24.

The size of the budget deficit remains uncertain. Fiscal estimates will continue to be refined through the revised May budget. If projections of the deficit widen, proposed spending levels would have to be further adjusted to ensure a balanced budget.

Health Care Budget Solutions

The proposed solutions are concentrated but not entirely outside of health care. Accordingly, the budget does not propose cuts or delays to recent major health care policy initiatives such as California Advancing and Innovating Medi-Cal (CalAIM) or the scheduled expansion in 2024 of comprehensive Medi-Cal coverage to undocumented immigrants ages 26-49 (the last age group that remains ineligible for such coverage).

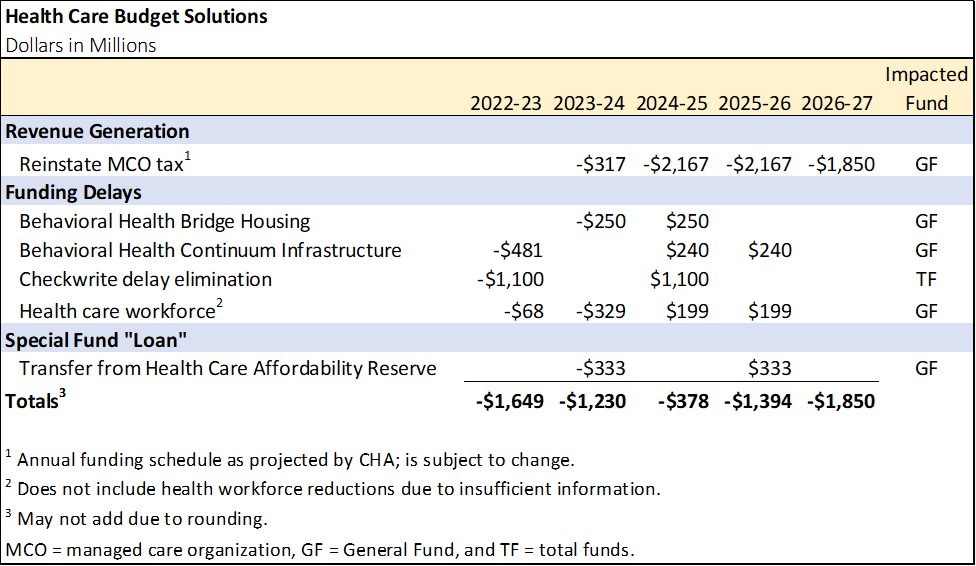

Proposed solutions in health care include:

- Reinstatement of the Managed Care Organization (MCO) Tax. For many years, the state has had a tax on MCOs, the revenues of which most recently generated about $1.5 billion in annual General Fund savings. Having expired at the end of December 2022, the January budget proposes a three-year renewal of the MCO tax beginning in 2024. As structured, the proposed tax would raise enough revenues to offset about $6.5 billion in General Fund spending in Medi-Cal over its lifespan, with $316 million in savings coming in 2023-24 and the rest in the following years. Messaging from the administration ties this funding to maintaining the scheduled expansion of Medi-Cal to undocumented immigrants.

- Delay — and Potential Reductions — in Health Care Workforce Funding. Last year, the budget approved a $1.5 billion package for the health care workforce. Around $1 billion was scheduled for expenditure across 2022-23 and 2023-24 (with the remainder expended over over the following two fiscal years). The January budget proposes to delay the nearly $398 million scheduled to be spent over the first two years and instead spend $199 million in both 2024-25 and 2025-26. While $130 million of this delayed spending reflects funding allocated to community health workers, it is unclear at this time what other health care workforce investments are proposed to be delayed. Additionally, the budget proposes “trigger reductions” to other recent health care workforce augmentations, which would occur if the budget does not have capacity to support them. These include:

- Public health workforce — reduced from $66 million to $16 million over four years

- Non-traditional apprenticeships — reduced from $175 million to $135 million over four years

- Emergency medical technician training — reduced from $60 million to $40 million over three years

- Delays Medi-Cal Checkwrite Buyback. Last year’s budget provided funding to eliminate, at the end of 2022-23, a two-week delay in Medi-Cal fee-for-service provider payments that occurs at the end of each state fiscal year (and was originally established to create one-time state savings). The January budget proposes to delay this elimination to 2024-25. As a result, about $1.1 billion in provider payments will continue to be delayed by two weeks until at least June 2025.

- Delays Behavioral Health Infrastructure Spending. The prior budget provided billions of dollars in funding for behavioral health clinical and housing infrastructure through the Behavioral Health Continuum Infrastructure and Behavioral Health Bridge Housing programs. The budget delays $731 million in planned expenditures in these programs from 2022-23 and 2023-24 to the following two years.

- Borrows from the Health Care Affordability Reserve Fund. This reserve fund was created to support reinstated or expanded state subsidies for coverage through Covered California. The budget proposes transferring the fund balance of $333 million to the General Fund to help the budget problem, with the intent of returning the same amount to the reserve in 2025-26 after temporarily enhanced federal subsidies for coverage expire.

The table below summarizes the proposed health care budget solutions.

No Relief for Hospitals

The budget does not include any additional support for hospitals. While the budget proposes to reinstate the MCO tax, it uses the funding to support pre-existing commitments rather than shoring up struggling Medi-Cal providers. However, the budget summary states an intent to explore opportunities to increase these revenues to “support the Medi-Cal program,” which could include relief for hospitals as well as other priorities. CHA released a media statement on the governor’s budget proposal.

Other Key Features of the Budget

Medi-Cal. The budget proposes Medi-Cal spending of $138 billion total funds ($32 billion General Fund) in 2022-23 and $139 million total funds ($39 billion General Fund) in 2023-24. General Fund spending in 2022-23 is revised downward by $4.5 billion, largely because of updated assumptions regarding the end of the federal COVID-19 public health emergency (PHE), changes in the timing of repayments owed to the federal government, and the proposed delay in behavioral health infrastructure funding described above. Caseload is projected to reach 15.5 million beneficiaries by July 2023; however, 2.7 million beneficiaries are projected to lose their eligibility by July 2024. This is due to the reinstatement of eligibility redeterminations that will occur in April 2023 (with the caseload impact expected to materialize starting two months later in July). Below are several noteworthy items in the Medi-Cal budget:

- Recognizes Scheduled Federal Reductions in Hospital Payments. Under federal law, disproportionate share hospital (DSH) payments are scheduled to decrease in the future. This is estimated to result in $864 million in reduced Medi-Cal payments for hospitals in 2023-24. Of this amount, $794 million reflects DSH reductions scheduled under federal law that have continually been deferred by the federal government. If deferred again, this $794 million funding reduction would be eliminated or reduced.

- Behavioral Health Community-Based Continuum Demonstration (IMD Waiver Demonstration). Currently, Medicaid does not provide federal funding for psychiatric hospitals and residential treatment programs, referred to in Medicaid as “institutions for mental disease” (IMDs), for services provided to Medicaid enrollees aged 21 to 64. The California Department of Health Care Services (DHCS) will seek approval of a new proposed Medicaid Section 1115 demonstration to begin drawing down billions of dollars in federal funds for IMD services. To qualify for the federal funds, the state would have to meet certain milestones related to the development of a broader continuum of mental health services. The budget assumes the demonstration will be implemented in January 2024.

- Assumes Approval of Additional Federal Waiver Funding and Reflects Associated Provider Rate Increases in Medi-Cal. An 1115 waiver request for $646 million (over multiple years) in federal Designated State Health Program funding remains pending before the federal government. According to the administration, to receive federal approval, the state must increase Medi-Cal reimbursement rates to 80% of Medicare rates for certain providers. The budget includes $23 million to increase provider rates for primary care and obstetric care (including for doulas). The remainder of the requested funding would support CalAIM’s Providing Access and Transforming Health Program, which serves the justice-involved population.

- Builds on CalAIM Implementation. The budget includes two major proposals related to CalAIM. First, it proposes to add six months of transitional rent for individuals who are or are at risk of experiencing homelessness and are transitioning out of institutional care, the corrections system, or foster care. This would be an additional CalAIM Community Support benefit (available at the discretion of Medi-Cal managed care plans). This is not proposed to be implemented until 2025-26. At full implementation, it is projected to cost $117 million annually. Second, the budget proposes to provide $375 million in one-time funding to counties to help them transition from cost-based reimbursement to a fee schedule where the nonfederal share of payments is covered by intergovernmental transfers.

- Does Not Reflect Recent Changes in Federal Law Related to the End of the PHE. The Medi-Cal budget does not incorporate changes under the Consolidated Appropriations Act of 2023 that decouple the expiration of enhanced federal Medicaid funding related to COVID-19 and the reinstatement of eligibility redeterminations from the federal COVID-19 PHE. While the assumed timing of the reinstatement of eligibility redeterminations is consistent with the change in federal law, the new law’s scheduled wind-down of enhanced federal funding does differ from budget assumptions, which will have to be modified in revisions to the budget.

- Reproductive Health Services Waiver. The budget proposes to create a new $200 million grant program in 2024-25 under an 1115 waiver to support access to family planning and related services, system transformation, capacity, and the safety net.

- New State Operations Resources. The budget proposes additional expenditure authority of $82 million ($16 million General Fund) for 145 positions for DHCS, which administers Medi-Cal. Most of the resource proposals are requests for staffing to implement recently approved legislation and address increasing workload. This includes resources to perform the Dental Managed Care contract procurement, Program of All-Inclusive Care for the Elderly operations and monitoring, and increased oversight of the Substance Use Disorder program.

Other Health. Key features of the health budget outside of Medi-Cal include:

- Reduced Support for COVID-19 Response. The budget assumes lower COVID-19 response expenditures of $614 million in 2022-23 compared to the 2022 Budget Act. The decrease is driven in part by reductions in COVID-19 response activities, such as vaccinations, testing, and public education.

- Lower Projected Mental Health Services Act (Proposition 63) Revenues. Proposition 63 (2004) established a surcharge of 1% on taxable income over $1 million to fund county mental health programs. While these revenues surged in recent years, the budget forecasts them to decrease from $5.6 billion in 2021-22 to $3.6 billion in both 2022-23 and 2023-24.

- Opioid Response. The budget proposes $93 million in opioid settlement funds over four years beginning in 2023-24. The funds would support youth- and fentanyl-focused opioid response efforts, including $79 million for the Naloxone Distribution Project, $10 million for fentanyl program grants for local efforts in support of AB 2365 (Patterson, 2022), and $4 million to increase the availability of fentanyl test strips and naloxone.